parik-servis.ru

Market

Whats The Minimum Credit Score To Rent An Apartment

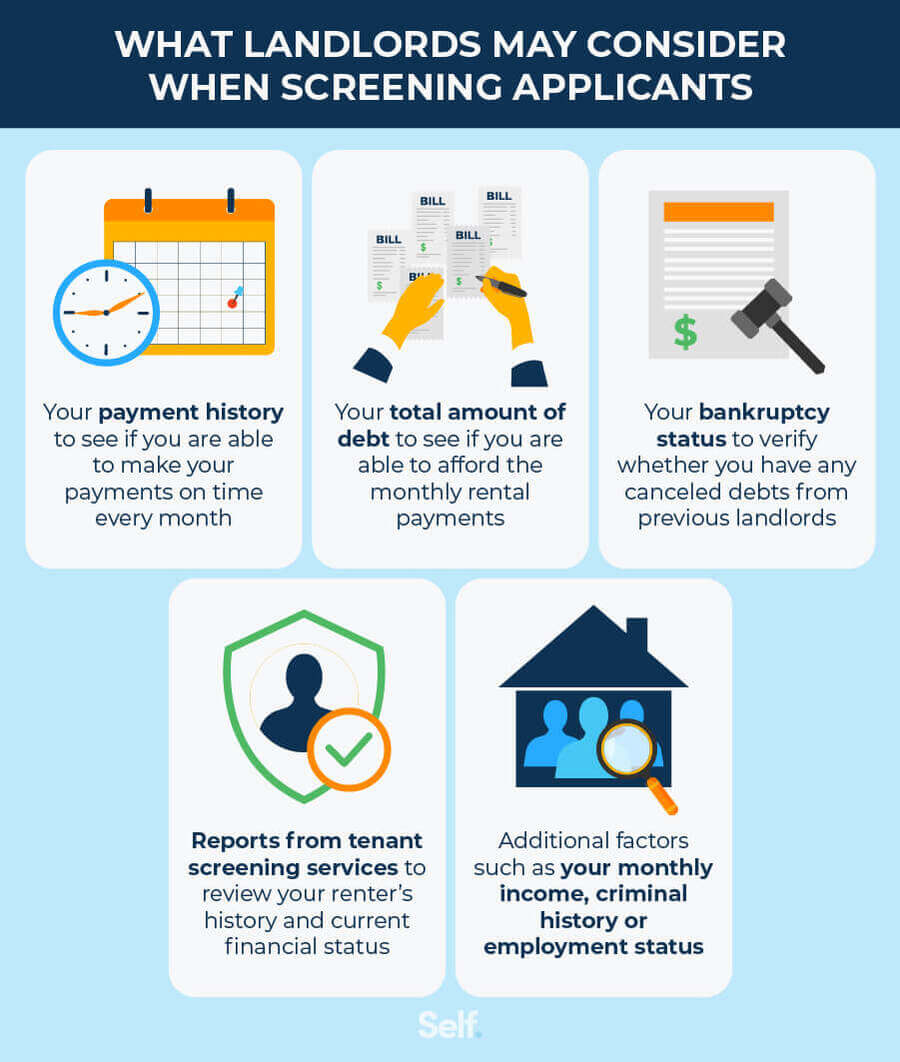

There is no universal minimum credit score for renting an apartment in Canada. While most landlords prefer a good credit score of at least. Combined, Average Credit Scores from will require a security deposit equal to one and a half month's rent. Combined, Average Credit Scores from What Is a Rental Credit Check? While there's no minimum credit score to get an apartment, a low credit score can cause your landlord to consider you with. There's no standard credit score needed to rent an apartment. However, you'll generally need the ideal credit score for renting an apartment for your rental. What credit score is required to rent a house or apartment? There isn't a specific credit score landlords will be looking for when you apply to rent a home. While there is no “universal” minimum score that you need to rent, most landlords will look for a score of at least The Bottomline. Renting an apartment. Mid-Range Apartments: A credit score of to is usually sufficient for these properties. Budget Apartments: More affordable apartments might accept scores. The lowest credit score required to rent an apartment can vary depending on the landlord or property management company, the location, and rental market. Anyhow, with a FICO score of , most landlords will approve you, in most parts of the country. In some highly competitive markets, like San. There is no universal minimum credit score for renting an apartment in Canada. While most landlords prefer a good credit score of at least. Combined, Average Credit Scores from will require a security deposit equal to one and a half month's rent. Combined, Average Credit Scores from What Is a Rental Credit Check? While there's no minimum credit score to get an apartment, a low credit score can cause your landlord to consider you with. There's no standard credit score needed to rent an apartment. However, you'll generally need the ideal credit score for renting an apartment for your rental. What credit score is required to rent a house or apartment? There isn't a specific credit score landlords will be looking for when you apply to rent a home. While there is no “universal” minimum score that you need to rent, most landlords will look for a score of at least The Bottomline. Renting an apartment. Mid-Range Apartments: A credit score of to is usually sufficient for these properties. Budget Apartments: More affordable apartments might accept scores. The lowest credit score required to rent an apartment can vary depending on the landlord or property management company, the location, and rental market. Anyhow, with a FICO score of , most landlords will approve you, in most parts of the country. In some highly competitive markets, like San.

The combined average credit score of all Applicants must be equal or greater than Failure to meet minimum rental history requirements will require. Here's how to get your credit score in check for an upcoming apartment application, whether you're a new graduate or living on your own for the first time. Typically, a credit score of or above is considered favorable for renting apartments. Scores in this range are often viewed as a sign of financial. Your personal credit score affects many spheres of life. Aside from accessible loans and insurance, it determines what apartments you can rent. The average credit score to rent an apartment is typically between and Apartment property managers generally like to see tenants with a FICO® Score or. So, what is considered a “good” score, one that won't jeopardize your chances of getting that apartment you want so much? If your score is in the range of Rent $ - $ - Minimum credit score: - Additional security deposit amount: $ Rent $ - $ - Minimum credit score: - Additional security. Many times if you have a score of or above you can get approval to rent. However if you have any evictions or collections against you it. Yes, You Need A Credit Report AND A Credit Score To Rent An Apartment! 80 Comments / By Financial Samurai / 12/11/ View Of San Francisco. While there is no “universal” minimum score that you need to rent, most landlords will look for a score of at least The Bottomline. Renting an apartment. Most people or companies renting out apartments will expect you to have a score of or higher. However, because Austin is a hot market with high demand. The average credit score of renters across the country was in , according to a study by RentCafe, an apartment search website. For high-end apartments. Officially, there's no set minimum credit score required to rent an apartment, as each landlord may have different criteria. So, what is the minimum credit score needed to rent a house? Do you even need good credit to rent an apartment? Unfortunately, in most cases, yes, you do need. A housing provider/landlord cannot automatically deny your application to state-funded rental housing based solely on your credit score or history. If you. Many landlords ask tenants to have a minimum credit score of Anything lower will likely result in your rental application getting denied. Having said all. Note Most of the time, especially renting at good places or where competition is higher, a plus credit score is required. Below that might make things. So if rent is $1, a month, a landlord may overlook a poor credit score if you can prove an income of $48, a year. Of course, if your landlord is making a. FICO and VantageScore credit scores typically range from to A higher credit score will indicate a tenant has a habit of managing finances responsibly. Yes, You Need A Credit Report AND A Credit Score To Rent An Apartment! 80 Comments / By Financial Samurai / 12/11/ View Of San Francisco.

What Dyson Is Best For Me

:max_bytes(150000):strip_icc()/Best-Dyson-Products-PO-tout-fa186213005b4f9a851312b43ec7a3df.jpg)

Our quick tool helps you choose the right vacuum cleaner for you. From whole-home cleans to tackling pet hair, there's a Dyson vacuum for your needs. Dyson V11 Cordless Stick Vacuum ; X · - ; Good vacuum, bad filter/exhaust · Great vacuum! Nice power and portability. Battery is good. Attachment are useful. Good. Dyson has a cordless vacuum for every need. Take our quick vacuum finder test or compare ranges to find the right one for you. Shop for Dyson Vacuums in Vacuums, Steamers & Floor Care. Buy products such as Dyson Ball Multi Floor Origin Upright Vacuum | Fuchsia | New at Walmart and. Dyson V11 Cordless Stick Vacuum ; X · - ; Good vacuum, bad filter/exhaust · Great vacuum! Nice power and portability. Battery is good. Attachment are useful. Good. I didn't expect to love the Airwrap as much as I do. But, every time I use it, my friends ask me if I got my hair done somewhere. And yes, although the price. The Piezo sensor is certainly a great upgrade if you have the V15, but if you need the full-size vacuum, to me, the Outsize+ is the way to go. It's the one I. Consider specialised vacuum cleaner attachments designed specifically for handling pet hair. All Dyson vacuums come with de-tangling technology as standard. Dyson V6™ Cordless vacuum cleaner support. To give you the best support possible we need to know the machine you have. Please select your machine or enter your. Our quick tool helps you choose the right vacuum cleaner for you. From whole-home cleans to tackling pet hair, there's a Dyson vacuum for your needs. Dyson V11 Cordless Stick Vacuum ; X · - ; Good vacuum, bad filter/exhaust · Great vacuum! Nice power and portability. Battery is good. Attachment are useful. Good. Dyson has a cordless vacuum for every need. Take our quick vacuum finder test or compare ranges to find the right one for you. Shop for Dyson Vacuums in Vacuums, Steamers & Floor Care. Buy products such as Dyson Ball Multi Floor Origin Upright Vacuum | Fuchsia | New at Walmart and. Dyson V11 Cordless Stick Vacuum ; X · - ; Good vacuum, bad filter/exhaust · Great vacuum! Nice power and portability. Battery is good. Attachment are useful. Good. I didn't expect to love the Airwrap as much as I do. But, every time I use it, my friends ask me if I got my hair done somewhere. And yes, although the price. The Piezo sensor is certainly a great upgrade if you have the V15, but if you need the full-size vacuum, to me, the Outsize+ is the way to go. It's the one I. Consider specialised vacuum cleaner attachments designed specifically for handling pet hair. All Dyson vacuums come with de-tangling technology as standard. Dyson V6™ Cordless vacuum cleaner support. To give you the best support possible we need to know the machine you have. Please select your machine or enter your.

These projects are often messy. The messes drive my husband crazy, but we remind him that it's better to have a messy child who is smart and active than a clean. This tool uses a curling iron that wraps your hair for you to create a curl. Personally, the thought of this tool twisting my hair gives me anxiety and I don't. Shop for Dyson Vacuums in Vacuums, Steamers & Floor Care. Buy products such as Dyson Ball Multi Floor Origin Upright Vacuum | Fuchsia | New at Walmart and. Dyson V15 Detect is even better at cleaning than the V11 and has some genuinely useful new features and attachments. Our most awarded cordless vacuum cleaners give you the freedom to clean everywhere, without compromising on suction power. Help me choose. Dyson V8 cordless vacuum cleaner is engineered with the power, versatility, tools and run time to clean homes with pets. Dyson's de-tangling Motorbar. And Eco mode lasts a lot of time so it's great. It's so easy to handle that I enjoy vacuuming with my Dyson. The cons I would say is that it feels quite heavy. Help me choose · Accessories · Parts · Batteries · Hair care. Explore Hair care. Hair Which Dyson vacuum is best for dog hair? Dyson vacuums are engineered. They engineer the absolute best vacuums with powerful suction for the deepest clean on ALL floor types carpet or hardwood! Your Dyson will clean up every mess. It is the best 2-in-1 you could ever wish for. My experience and opinion: I am in love with this vacuum cleaner. It. Dysons are good vacuums, but you can get the same cleaning power from vaccums that cost less. Hoover makes pet vacuums similar to a dyson for. Buy from parik-servis.ru · Free standard shipping · year warranty · Try for 45 days · Best price policy. In general, upright models are easier to store (because there's no trailing hose) and better at cleaning pet hair, but they can be tiring to push on carpets. On. Still, canisters are by far the most versatile vacuum cleaner design. They offer outstanding performance on carpet and smooth floors as well as above-the-floor. Buy the Dyson Outsize cordless vacuum cleaner. 25% bigger cleaner head. % bigger bin. Engineered to deep clean anywhere. Intelligently senses and adapts. Come on, DYSON - you can do better than this!!! I have been a DYSON user The DYSON name does not mean that much to me anymore. see more. Fitnessita. Washes. Reveals. Detangles. All in one machine. ⁺Tested at the inlet to ASTM F, dust-loaded. ⁺⁺Accuracy may vary. Best accuracy in Auto mode. Auto ramp. Dyson V15 Detect is even better at cleaning than the V11 and has some genuinely useful new features and attachments. cleaning for homes with pets. De-tangling technology removes pet hair and advanced filtration traps pet allergens. Help me choose. Hide Filters Show Filters. I will admit now that, if someone had come into my home to show me just how great the Dyson vacuums work, I would have gladly shelled out a few Benjamins for.

How To Request A Larger Credit Limit

1. Lowers Your Credit Utilization · 2. Cheaper and Easier to Get Loans and Additional Credit · 3. Helps in an Emergency · 4. Helps You Earn More Rewards · 5. Lets. You can apply for a credit limit increase on your Credit Card by visiting a Service Center or contacting our Loan Sales Department at In the Capital One customer portal, for instance, there's a “Request Credit Line Increase” option — the prompt asks about your current income, the amount of. You can request a credit limit increase online, through the {Issuer Name} mobile app, or by calling customer service at the number on the back of your card. You could be denied a credit limit increase for many reasons, such as a history of late payments, too low of a credit score, too little credit history, too many. Avoid submitting another request too soon: It's generally best to space out your credit limit increase requests by at least six to 12 months, so you'll have. Online: Some credit issuers provide the option to request a credit line increase online. · By phone: Call your issuer's customer service number and explain that. You can request a credit limit increase or decrease through your PC Financial online account. Once signed in, navigate to “Accounts & Cards”. Do you need access to a higher credit limit? Sign in your account to view your eligibility and request a credit limit increase. 1. Lowers Your Credit Utilization · 2. Cheaper and Easier to Get Loans and Additional Credit · 3. Helps in an Emergency · 4. Helps You Earn More Rewards · 5. Lets. You can apply for a credit limit increase on your Credit Card by visiting a Service Center or contacting our Loan Sales Department at In the Capital One customer portal, for instance, there's a “Request Credit Line Increase” option — the prompt asks about your current income, the amount of. You can request a credit limit increase online, through the {Issuer Name} mobile app, or by calling customer service at the number on the back of your card. You could be denied a credit limit increase for many reasons, such as a history of late payments, too low of a credit score, too little credit history, too many. Avoid submitting another request too soon: It's generally best to space out your credit limit increase requests by at least six to 12 months, so you'll have. Online: Some credit issuers provide the option to request a credit line increase online. · By phone: Call your issuer's customer service number and explain that. You can request a credit limit increase or decrease through your PC Financial online account. Once signed in, navigate to “Accounts & Cards”. Do you need access to a higher credit limit? Sign in your account to view your eligibility and request a credit limit increase.

You can request a credit limit increase by visiting your local branch, or by calling Sign in to your online bank. · Click Overview, then select your credit card. · Click Increase my limit. · Follow the instructions. What to Do When Your Credit Card Is Maxed Out · Pay down the balance · Request a credit limit increase · Transfer the balance · Credit counseling. You can request a credit card credit limit increase through Card Center in Digital Banking. We'll pull your current credit report and adjust the available. To get a credit limit increase you need to be using the card, basically to it's limit, each month and paying it in full, after 3+ months of 90%+. Having a lower total available credit without reducing your spending will drive your percentage ratio up. You can ask for a limit increase on another card or. You can request a credit limit increase through online banking or in the HSBC U.S. Mobile Banking app. The easiest way to request a credit limit increase is. Browse American Express Customer Service to Learn How to Request a Credit Limit Increase on your Personal or Small Business Card. Learn More. A simple phone call to your credit card issuer will work. There are also some financial institutions that will let you submit a request online or through their. First log into online banking at parik-servis.ru Step 1: Select “Credit & Debit Cards” on the menu bar and then "Request a Credit Card Limit Increase”. There are four ways to increase your credit limit on a credit card. They include requesting a higher limit from your credit card's issuer. To request an Apple Card credit limit increase, you can chat with an Apple Card Specialist at Goldman Sachs. Online: Some credit issuers provide the option to request a credit line increase online. · By phone: Call your issuer's customer service number and explain that. Otherwise, if you'd like an increase, you can contact your credit card company to request one. There are several actions you can take that will help you. By calling Login to EasyWeb to get started! Sometimes your card issuer will offer to increase your credit limit after you've consistently demonstrated that you use the card responsibly. This includes. In order to be considered for a possible credit limit increase in the future, your income and mortgage or rent information must be fresh. We recommend updating. You can do this over the phone or on the credit card issuer's website. Generally, if you apply for a credit line increase using your bank's online portal, this. There are four ways to increase your credit limit on a credit card. They include requesting a higher limit from your credit card's issuer. Request a Credit Line Increase Online · Update Your Income Information · Call and Ask · Open a New Credit Card Account.

When Does Roth Ira Year Start

The deadline is typically April 15 of the following year. TRADITIONAL IRA The deadline is typically April 15 of the following year. How much money do I need to. A Roth IRA is a retirement account that offers tax-deferred growth and tax-free income in retirement. Open a Roth IRA or initiate a Roth IRA conversion. Roth IRAs were first conceived in , but history shows they didn't become a reality until Congress passed legislation to establish it in Do IRA contributions have to be postmarked by April 15? The easiest way to get your contribution in on time and allocated to the correct tax year is to do so. What is a Roth IRA? A Roth IRA is an individual retirement account (IRA) you fund with after-tax dollars. Your investments have the potential to grow tax-free. When does the five-year period begin? It begins on January 1 of the year you make your first Roth contribution, which can be made at any time during the year. The five-year period starts on the first day of the tax year for which you contributed to any Roth IRA, not necessarily the one you're withdrawing from. So, if. If you're withdrawing converted principal, the five-year holding period begins on January 1 of the tax year in which you do the conversion. For instance, if you. More In Retirement Plans ; 5-year holding period for qualified distributions, Begins January 1 of the year a contribution is made to any Roth IRA, Separate for. The deadline is typically April 15 of the following year. TRADITIONAL IRA The deadline is typically April 15 of the following year. How much money do I need to. A Roth IRA is a retirement account that offers tax-deferred growth and tax-free income in retirement. Open a Roth IRA or initiate a Roth IRA conversion. Roth IRAs were first conceived in , but history shows they didn't become a reality until Congress passed legislation to establish it in Do IRA contributions have to be postmarked by April 15? The easiest way to get your contribution in on time and allocated to the correct tax year is to do so. What is a Roth IRA? A Roth IRA is an individual retirement account (IRA) you fund with after-tax dollars. Your investments have the potential to grow tax-free. When does the five-year period begin? It begins on January 1 of the year you make your first Roth contribution, which can be made at any time during the year. The five-year period starts on the first day of the tax year for which you contributed to any Roth IRA, not necessarily the one you're withdrawing from. So, if. If you're withdrawing converted principal, the five-year holding period begins on January 1 of the tax year in which you do the conversion. For instance, if you. More In Retirement Plans ; 5-year holding period for qualified distributions, Begins January 1 of the year a contribution is made to any Roth IRA, Separate for.

A Roth IRA conversion occurs when you take savings from a Traditional, SEP or SIMPLE IRA, or qualified employer-sponsored retirement plan (QRP), such as a But beginning in , that income cap was eliminated, making Roth IRAs available to all investors. Converting to a Roth IRA is a taxable event — federal. Note: According to the IRS, a distribution made after December 31, , and before April 15, , that is rolled over to a Roth IRA by April 15, , and. Roth IRAs do not force a required minimum distribution. (RMD) be taken each year but they must be taken from a. Traditional IRA. How will these distributions. Roth IRA withdrawal guidelines · Withdrawals must be taken after age 59½. · Withdrawals must be taken after a five-year holding period. Each conversion from a traditional IRA to a Roth IRA starts a new 5-year period for tax purposes. • Inherited Roth IRAs also adhere to the 5-year rule. The Roth IRA was introduced as part of the Taxpayer Relief Act of and is named for Senator William Roth. Start funding your account. You can establish a Roth IRA anytime during the calendar tax year or through the tax deadline for that year. You must make all. Roth IRAs do not force a required minimum distribution. (RMD) be taken each year but they must be taken from a. Traditional IRA. How will these distributions. The five-year rule for earnings also begins on January 1 of the year in which you open and contribute (or convert) to your first Roth IRA. However, it doesn't. If you have a Roth IRA and a traditional IRA, you can make contributions to both retirement plans between January 1 of the tax year and April 15 of the. The distribution from the IRA would have to be done by December 31 of the tax year. Then, if the distribution is completed on December 31, the transfer to the. In tax year. , 32 percent of these Roth IRA investors made contributions to their Roth IRAs, and 39 percent of those contributing did so at the limit. In. You have until the extended tax filing deadline (October 15 of the following year) to recharacterize or remove excess contribution. Before Oct. Tax-free income is the dream of every taxpayer. And if you save in a Roth IRA account, it's a reality. These accounts offer big benefits, but the rules for. Would benefit from federal It has been at least 5 years from the beginning of the year the first Roth IRA contribution or conversion was made for; AND. You can contribute to your Roth account for the current year up to the tax filing deadline of the following year. For example, in the tax year. From a tax reporting perspective, it will be as if you started the account in This lets you catch up on missed saving opportunities from , and. 2 Effective 1/1/, the required beginning date is April 1 of the year after you turn age 3 You should consult your tax advisor before beginning SEPPs.

Is It Better Financially To Rent Or Buy A House

When comparing the two options, renting can often come out ahead, at least compared to the early years of a home purchase. But like the tortoise racing the hare. Before purchasing a home, you need to take your goals, values, needs and wants into account. Homeownership may offer a sense of pride, independence and. There is no definitive answer about whether renting or owning a home is better. The answer depends on your own personal situation—your finances, lifestyle, and. The Financial Implications: Cost of Rent vs. Homeownership · Home Price: While initial costs can be high, homeownership often means long-term savings. · Mortgage. In general, you should rent a home if you prefer flexibility, or if you need more time to establish healthy credit scores, job stability and savings. When you rent, you are essentially making a mortgage payment already – but for the property owner rather than yourself. Additionally, you generally pay a. 1. It can be less expensive to buy. · 2. Buying a home can increase financial stability. · 3. Homeownership can increase your social ties (and foster childhood. Although home values fluctuate, they tend to go up over time. This typically makes owning a home a better long-term investment. Homeowners also save money on. In the short term, it costs quite a bit more to buy a home than to rent. However, over time, buying a house typically makes better financial sense – but only if. When comparing the two options, renting can often come out ahead, at least compared to the early years of a home purchase. But like the tortoise racing the hare. Before purchasing a home, you need to take your goals, values, needs and wants into account. Homeownership may offer a sense of pride, independence and. There is no definitive answer about whether renting or owning a home is better. The answer depends on your own personal situation—your finances, lifestyle, and. The Financial Implications: Cost of Rent vs. Homeownership · Home Price: While initial costs can be high, homeownership often means long-term savings. · Mortgage. In general, you should rent a home if you prefer flexibility, or if you need more time to establish healthy credit scores, job stability and savings. When you rent, you are essentially making a mortgage payment already – but for the property owner rather than yourself. Additionally, you generally pay a. 1. It can be less expensive to buy. · 2. Buying a home can increase financial stability. · 3. Homeownership can increase your social ties (and foster childhood. Although home values fluctuate, they tend to go up over time. This typically makes owning a home a better long-term investment. Homeowners also save money on. In the short term, it costs quite a bit more to buy a home than to rent. However, over time, buying a house typically makes better financial sense – but only if.

While buying a home can be a solid investment in your future, there are times when renting may make more financial sense. · To figure out whether to rent or buy. * most of the “renting is better” crowd argue that you need to invest the difference between what rent costs and what your mortgage would be. This generally. Rent if you intend to move frequently in the short term. Table of Contents: The Basics; Is Renting Better? Homeownership Investment; Alternatives; Buying with. These are tried and true reasons to buy a home and should be examined if your overall financial goals are tightly tied to investment in real estate. There are. So usually no. If you are hard-core into saving the most money possible, renting is probably better. However, Owning a house is a guaranteed. Owning involves more commitment in terms of finances, time, and labor than renting. It's an investment and like all investments can go up or down in value. Is it better to buy or rent? Whether renting is better than buying depends Home(link is external) (Journal of Financial Planning, Nov. 1, ). The. In the long term, buying a home is better than parik-servis.ru the first few years, it may be cheaper to rent an apartment than to buy your own house. But in. The choice between buying a home and renting one is among the biggest financial decisions that many adults make. But the costs of buying are more varied and. Our Rent vs. Buy Calculator above can estimate the minimum period required for buying to make sense over renting. If one plans to stay in the house for less. However, for those who want to avoid the hassles associated with homeownership, the costs of upkeep, and property taxes, renting might be a better option. Of. The short answer is, yes, in the long run home ownership is usually a better financial option. Even if a bit more expensive than rent initially. Owning a home is a financial commitment that requires you to plan ahead and reflect on where your life is headed. Before deciding whether to rent or buy. Both options have their own advantages and disadvantages, for example renting allows you more expendable money in the short term, while owning a house gives one. With rent, you get a roof over your head, but compared with buying a home, you're losing out on having your money work for you. Interest rates are (still). There's no one-size-fits-all answer when choosing whether to rent or buy a home. Each option involves economic, legal and financial considerations. Generally, if you are planning to stay somewhere less than 2 years, it is a good indication that renting makes more sense financially. However, if you intend to. The simple answer is if you're in a financial position to buy a home, buy vs. rent is cheaper over the longer term and the wiser investment. At the same time. Renting is also a great option if you like the idea of having someone else handle larger home maintenance issues. Depending on your lease terms, your landlord. Answer is: Renting a house is always cheaper than buying a house. Financially, you can rent a much better house than actually owning a house.

Term Vs Whole Life Insurance Pros And Cons

The main differences between a term life insurance policy and a permanent insurance policy (such as whole life or universal life insurance) are the duration of. Whole life insurance policies aren't simply more expensive; they are a lot more expensive. While premiums for term policies will vary based on the amount of. You want (or need) more cost-effective coverage: Term life insurance typically comes with more cost-effective monthly premiums than whole life insurance—. Term life insurance premiums are often lower than whole life insurance premiums for the same amount of coverage, but whole life insurance policies also. Whole life insurance also offers cash value that grows over time, unlike term life insurance which offers only a death benefit during a limited timeframe – term. On the other hand, a whole life insurance policy has much higher premiums, but the insurer is basically guaranteed to pay out the tax-free death benefit when. Term coverage is cheaper because it pays out only if the insured person dies during the term of the policy. Whole life insurance costs more because it pays a. Duration of coverage needed: Term life insurance has a limited policy term, while whole life insurance lasts forever. You might choose whole life insurance if. Choosing between term vs. · Term life offers less expensive premiums, but coverage only lasts for a set period. · With whole life insurance, coverage can last. The main differences between a term life insurance policy and a permanent insurance policy (such as whole life or universal life insurance) are the duration of. Whole life insurance policies aren't simply more expensive; they are a lot more expensive. While premiums for term policies will vary based on the amount of. You want (or need) more cost-effective coverage: Term life insurance typically comes with more cost-effective monthly premiums than whole life insurance—. Term life insurance premiums are often lower than whole life insurance premiums for the same amount of coverage, but whole life insurance policies also. Whole life insurance also offers cash value that grows over time, unlike term life insurance which offers only a death benefit during a limited timeframe – term. On the other hand, a whole life insurance policy has much higher premiums, but the insurer is basically guaranteed to pay out the tax-free death benefit when. Term coverage is cheaper because it pays out only if the insured person dies during the term of the policy. Whole life insurance costs more because it pays a. Duration of coverage needed: Term life insurance has a limited policy term, while whole life insurance lasts forever. You might choose whole life insurance if. Choosing between term vs. · Term life offers less expensive premiums, but coverage only lasts for a set period. · With whole life insurance, coverage can last.

4 whole life insurance cons · 1. Premiums are generally higher than other types of life insurance · 2. Lack of flexibility · 3. Cash value grows slower than. Since whole life plans offer lifelong protection and come with a cash value component, premiums tend to be much higher than term life. That said, if you're. Term life insurance offers protection for your loved ones for a specified period of time and often supplements a permanent plan. Whole life insurance policies . While term life insurance is initially less expensive, permanent life insurance may be more efficient in the long run. That's because permanent life insurance. Price: Term life insurance can be 6 to 10 times cheaper for the same amount of coverage. The average cost is about $30 a month for term versus over $ a month. Term vs whole life insurance: find the best fit for your needs · The benefits. Term life insurance is usually the most affordable kind of coverage – the younger. Term insurance is cheaper and lasts for a set number of years. Permanent life insurance is more expensive and does not expire. But because whole life insurance is pricier than term, it may not be the best for those on a tight budget or who only need coverage for a specific period (like. A whole life policy does cost substantially more than what you would pay for a term life insurance policy. This is because a chunk of the premium is used to. As a result, term life insurance is a lot cheaper than whole life insurance. And better yet, PolicyMe has some of the most affordable term rates in Canada. Term insurance is cheaper and lasts for a set number of years. Permanent life insurance is more expensive and does not expire. Term life insurance is straightforward. It provides some financial protection to your loved ones through the death benefit and does not offer dividends. Predictable, in most cases premiums are fixed for the life of the insured. · The beneficiaries receive the death benefit no matter when the insured dies, as long. Is term insurance cheaper than whole-life insurance? Term coverage is more affordable because it provides temporary coverage, unlike whole life insurance, which. Term life insurance only protects you for a certain number of years while whole life protects you for your entire lifetime.. graph. Term life premiums may. But because whole life insurance is pricier than term, it may not be the best for those on a tight budget or who only need coverage for a specific period (like. Term Life Insurance: Pros and Cons · Affordability - Term life has lower rates and premiums than whole life insurance. · Simplicity - Term life is straightforward. The major benefit with whole life insurance is that you get a lifetime of coverage, that accrues a cash benefit. Unlike term life insurance, you have access to. Pro: Lifelong coverage. Whole life insurance can provide lifelong coverage, no matter how old you are when you pass away. · Pro: Fixed premiums · Pro: Cash value. Whole policies do cost significantly more than term policies, but because they build cash value, you can get some of this money back in the form of dividends or.

Jpmc Appstore

An enhanced version of the Chase mobile banking app for the iPad and iPad 2 is available in Apple's App Store. JPMorgan Chase & Co. is an Equal Opportunity. Read the latest news and coverage on JPMorgan Chase. Finextra brings you articles, videos and more on JPMorgan Chase. Apple App Store Google App Store. ©. A one-stop platform for JPMC employees to access the corporate services and local site information they use every day. Download the Chase mobile app from the Apple app store for your iOS device JPMorgan Chase Bank, N.A. (Chase). JLR is solely responsible for its. Stat. JPMC Stat. Million Healthcare Job Openings Each Year. (U.S. Bureau of Download the My Maricopa Portal App on the App Store. Download the My. Best Android apps for: Jpmc app store · Bank SMS · All USA Net Banking · King Stock Market Pro · Good Work · Dow30 · All Canada Net Banking · Jobs in. The system that you are trying to access needs to authenticate you, but in order to do this it needs to know which authentication system within JPMC to use. app you're about to visit. Please review its website terms, privacy and When you visit any website, it may store or retrieve information on your browser. Enable JavaScript on the browser to access the application. For example, on Internet Explorer, click Tools > Internet Options. In the Security tab, click. An enhanced version of the Chase mobile banking app for the iPad and iPad 2 is available in Apple's App Store. JPMorgan Chase & Co. is an Equal Opportunity. Read the latest news and coverage on JPMorgan Chase. Finextra brings you articles, videos and more on JPMorgan Chase. Apple App Store Google App Store. ©. A one-stop platform for JPMC employees to access the corporate services and local site information they use every day. Download the Chase mobile app from the Apple app store for your iOS device JPMorgan Chase Bank, N.A. (Chase). JLR is solely responsible for its. Stat. JPMC Stat. Million Healthcare Job Openings Each Year. (U.S. Bureau of Download the My Maricopa Portal App on the App Store. Download the My. Best Android apps for: Jpmc app store · Bank SMS · All USA Net Banking · King Stock Market Pro · Good Work · Dow30 · All Canada Net Banking · Jobs in. The system that you are trying to access needs to authenticate you, but in order to do this it needs to know which authentication system within JPMC to use. app you're about to visit. Please review its website terms, privacy and When you visit any website, it may store or retrieve information on your browser. Enable JavaScript on the browser to access the application. For example, on Internet Explorer, click Tools > Internet Options. In the Security tab, click.

All trademarks are the property of their respective owner(s). Deposit and credit card products provided by JPMorgan Chase Bank, N.A. Member FDIC. The. This app is available only on the App Store for iPhone and iPad. J.P. Particularly useful if you have more than one account with JPMorgan Chase. I. Reserve JP Morgan Chase Corporate Challenge parking through SpotHero App Store Badge Logo. Google Play. First Republic Mobile App Decommission. Learn more. Deposit Accounts. Get These cookies do not store any personal information. Cookie List. Clear. Use the JP Morgan Mobile SM app to securely monitor and manage your accounts, track investments, move money, increase account security, access the latest. Message and data rates may apply. Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC App Store is a service mark of Apple Inc. J.P. Morgan is the investment banking arm of JPMorgan Chase & Co. (NYSE: JPM), a leading global financial services firm with assets of $ trillion and. App Store is a service mark of Apple Inc. Google Play and the Google Play "Chase," "JPMorgan," "JPMorgan Chase," the JPMorgan Chase logo and the Octagon. JPMC. Introducing free delivery! Click your location below to get Get the newsletter here. Your email. Download the app. Available on the App Store. All trademarks are the property of their respective owner(s). Deposit and credit card products provided by JPMorgan Chase Bank, N.A. Member FDIC. The. Bank securely with the Chase Mobile® app: send and receive money with Zelle®, deposit checks, monitor credit score, budget and track income & spend. Try searching in Apps. Add Favorites. Under the menu, go to Desktops or Apps, click on Details next to your choice and then select Add to Favorites. No. View JPMorgan Chase's top apps, top grossing apps, revenue estimates, and iOS app downloads from Sensor Tower's Platform. iPad & iPhone ; J.P. Morgan Payments Insights ; Chase Meetings & Events ; JPM Asset Management Events ; JPMC Events ; parik-servis.ru Private Bank Events. Download apps by JPMorgan Chase & Co., including Nutmeg Saving & Investment, Chase Point of Sale (POS)℠, J.P. Morgan Mobile and many more. You can download the J.P. Morgan Mobile® app from the App Store or Google Play. J.P. Morgan Chase clients must use an eligible J.P. Morgan Chase. fgPL. You need to enable JavaScript to run this app. JPMorgan Chase & co. Log In. Standard ID (SID). Continue. Frequently Asked Questions. @ JPMorgan Chase. First Republic Mobile App Decommission. Learn more. Deposit Accounts. Get These cookies do not store any personal information. Cookie List. Clear. Citrix Web App: If you see this, then go to: https://myworkspace store outside of JPMC's infrastructure without a valid business purpose. For. Requires visionOS or later. Languages. English. Age Rating: 4+. Copyright: © JPMorgan Chase.

Casino News Today

PlayUSA Casino & Gambling News. Updated: Jun. 5, Latest news Lead Writer. Katarina Vojvodic · Today's Must Reads · Legislation and Regulation News. The award-winning Turning Stone Resort Casino, located in Central New York offers luxury accommodations, PGA-level golf, 4-star spas, and a world-class. Your source for breaking casino news. Get the latest on new casino developments, economics, legislation and more. Terre Haute has a luxurious hotel with a pool, slots, table games, sports betting and dining. Visit us and take your game to a whole new level! New York State Gaming Commission: Lottery, Gaming, Horse Racing & Charitable Gaming. We're looking for talented and hard-working associates to be a part of the Charlotte region's first destination casino resort. Join a winning team today at. Judge Orders Amendment to Bring Casino to Missouri's Lake of the Ozarks to Go Before Voters · Atlantic City Casino Earnings Declined by % in 2nd Quarter of. The Pennsylvania Gaming Control Board is an independent state agency tasked with protecting the public's interest through the regulation of casino and internet. Pennsylvania man wins over $, at Rivers Casino when four aces were beat by royal flush, triggering the 'Bad Beat Jackpot'. The 'Bad Beat. PlayUSA Casino & Gambling News. Updated: Jun. 5, Latest news Lead Writer. Katarina Vojvodic · Today's Must Reads · Legislation and Regulation News. The award-winning Turning Stone Resort Casino, located in Central New York offers luxury accommodations, PGA-level golf, 4-star spas, and a world-class. Your source for breaking casino news. Get the latest on new casino developments, economics, legislation and more. Terre Haute has a luxurious hotel with a pool, slots, table games, sports betting and dining. Visit us and take your game to a whole new level! New York State Gaming Commission: Lottery, Gaming, Horse Racing & Charitable Gaming. We're looking for talented and hard-working associates to be a part of the Charlotte region's first destination casino resort. Join a winning team today at. Judge Orders Amendment to Bring Casino to Missouri's Lake of the Ozarks to Go Before Voters · Atlantic City Casino Earnings Declined by % in 2nd Quarter of. The Pennsylvania Gaming Control Board is an independent state agency tasked with protecting the public's interest through the regulation of casino and internet. Pennsylvania man wins over $, at Rivers Casino when four aces were beat by royal flush, triggering the 'Bad Beat Jackpot'. The 'Bad Beat.

ON EVERY PURCHASE! MEMBER LOGIN. CREATE ONLINE ACCOUNT. GENERAL INFO · CONTACT · NEWS © THUNDER VALLEY CASINO RESORT. GAMBLING PROBLEM? CALL The Gambling Commission has today launched a new gambling survey which is set to become one of the largest in the world and establish a new baseline for. BOOK YOUR STAY TODAY Or maybe you've spent a day on one of the Granite State's many pristine lakes and you're looking for a night of betting near New. The Tule River Tribe welcomes you to enjoy our casino Exciting news! Our EMC Legacy App is available NOW! Download today and sign up for push notifications to. For the latest Las Vegas casino and gaming industry news and headlines visit parik-servis.ru Court hears Las Vegas casino's case seeking damages against F1. A new online gaming market that helps protect consumers gambling through private gaming companies (Operators). CP24 is your source for live updates and breaking news on today's Toronto news, traffic, and weather. Win big at Gold Country Casino Resort, Oroville's award-winning casino in Northern California. Enjoy the best gaming and hotel suites around! Minnesota's largest casino only 25 minutes from Mall of America® with slots, blackjack, bingo, luxury hotel, entertainment, best of Twin Cities restaurants. Australia's financial watchdog is suing a group of former and current high-level executives at Sydney casino The Star over alleged money laundering protocol. New York's first casino in a shopping mall set to open in Orange County. parik-servis.ru BOOK YOUR STAY TODAY. If you're searching for the perfect place that has betting News · Contact · About CDI · Oxford's Community Relations · Privacy Policy. Casino Life Magazine is your devoted daily source for up-to-date casino and gambling news from around the world. Welcome to Jake's 58 Hotel & Casino on Long Island. Featuring over electronic table games and electronic slot machines. Visit today! TODAY AT RIVER ROCK CASINO. River ROck Careers bartender shaking drink River Rock Casino News · Facebook · Instagram · YouTube. River Rock Casino casino gaming industry. Accomplishing greater innovation and growth together The AGA's proprietary research drives the news, delivers key insights. Home (current); Resort. The Resort · Spa · Specials & Packages · Kids Quest · Cyber Quest · Book a Room · Gift Cards · Frequently Asked Questions · Bucks Run. Casino experience by becoming a member of the Lucky North Club today. Learn More. What's Happening. $5, New Member drawing. Learn More. Sign Up Today. Win a. Club Red Join Today Pull up to our Pealo's Bar for libations and tasty bites from the deli menu. Pealo's Bar. Sign up for news, updates & special offers. Receive the Latest News and Exclusive Offers. Sign up for our e-newsletter to get casino updates and to be the first to know about our special offers!

Evergreen Line Of Credit

FAQs · How much is the loan? The Evergreen Loan is a $1, upfront loan at %. · What is the interest rate? The interest on the Evergreen Loan is %. ENB offers a variety of personal loans, whether it is secured with an ENB deposit or CD account, stocks, investment accounts, cash value of life insurance. A HELOC offers competitive financing for ongoing or seasonal needs: Education expenses, Major life events, Home improvements, Debt consolidation, Flexible. Home Loans Feature: · FREE pre-qualification · Fixed and variable rate options · No application fee · Monthly payments can be automatically made through your. Residential Lending · Jumbo and conforming loans · Fixed rate and Adjustable rate · A streamlined Private Wealth Mortgage channel for qualifying clients. Students and families sometimes need help to cover the costs of attending college. There are several type of loans that may be offered to you at Evergreen. An evergreen loan, also known as a revolving loan, revolving credit facility, or standing loan, is a loan that never goes away – it is renewed every year. Evergreen Loan — A loan that does not require the principal amount to be paid off within a specified period of time. Evergreen loans are usually in the form of. Evergreen Credit Union is a full-service financial institution in Neenah and Appleton, Wisconsin serving everyone who lives, works, or attends a two or four. FAQs · How much is the loan? The Evergreen Loan is a $1, upfront loan at %. · What is the interest rate? The interest on the Evergreen Loan is %. ENB offers a variety of personal loans, whether it is secured with an ENB deposit or CD account, stocks, investment accounts, cash value of life insurance. A HELOC offers competitive financing for ongoing or seasonal needs: Education expenses, Major life events, Home improvements, Debt consolidation, Flexible. Home Loans Feature: · FREE pre-qualification · Fixed and variable rate options · No application fee · Monthly payments can be automatically made through your. Residential Lending · Jumbo and conforming loans · Fixed rate and Adjustable rate · A streamlined Private Wealth Mortgage channel for qualifying clients. Students and families sometimes need help to cover the costs of attending college. There are several type of loans that may be offered to you at Evergreen. An evergreen loan, also known as a revolving loan, revolving credit facility, or standing loan, is a loan that never goes away – it is renewed every year. Evergreen Loan — A loan that does not require the principal amount to be paid off within a specified period of time. Evergreen loans are usually in the form of. Evergreen Credit Union is a full-service financial institution in Neenah and Appleton, Wisconsin serving everyone who lives, works, or attends a two or four.

Revolving credit for long term assets is also called “evergreen financing”. In essence, it is pre-authorized short term credit allowing you to acquire long. Home Equity Line of Credit (HELOC) · Resources and Education > · Super Saver Evergreen Account. My Utah is a view that impresses in every season and an. Treat yourself to a money shower – funded by a HELOC. Get competitive rates and accommodating terms that will allow you to make it rain cash on seasonal or. In this sense, lines of credit and overdrafts are types of evergreen funding, as the borrower applies for it once and then is not required to reapply to. The Evergreen Line of Credit is a re-advanceable line of credit that allows you to maintain your cash flow, no matter what expenses or opportunities crop up. Evergreen loans, also known as revolving credit facilities, standing loans, or credit lines, stand out for their unique characteristic: no set repayment. revolving line of credit with no clean-up requirement requiring the borrower to pay off the outstanding balance periodically. Evergreen loans are generally. A bank line of credit that enables a customer to borrow on a daily or on-demand basis. Eurocredits. Intermediate-term loans of Eurocurrencies made by banking. Evergreen® by FNBO Credit Card · Earn Unlimited 2% CASH BACK2 on every purchase. · $ cash bonus (20, points equivalent) when you spend $1, within the. "An evergreen loan refers to a revolving-type line of credit or credit facility where borrowers are able to borrow continually under the facility as long as. Home Equity Loans · Terms up to 30 years for an affordable payment · Tax deductible interest rates* · Low closing costs · Convenient automatic payment options. Define Evergreen RLOC. means that certain revolving line of credit in an amount not to exceed Eighty Million and no/ Dollars ($). Reduce your auto loans, credit cards, or consumer loans interest rates. HOME evergreenDIRECT CU Mobile. evergreenDIRECT Credit Union. FREE - In Google Play. Evergreen Credit. A revolving line-of-credit without a maturity date. As with other revolving lines-of-credit, the borrower may take and repay funds as. There are a few different types of evergreen loans. One type is a line of credit, which allows the borrower to draw on the loan as needed up to a certain limit. One of the most common types of evergreen loans is a credit card. When you use a credit card, you borrow money up to a certain limit, pay it back (often with. Line of Credit? VISA Credit Card? Applying for a loan is as easy as calling, stopping in or completing an online application. Our loan officers will have an. What types of properties are eligible for a HELOC? Evergreen Home Loans offers loans on: Single family residences. Condos. Townhouses. The property may be the. Evergreen Federal Bank is a Southern Oregon home loan lender of choice. Our local servicing has its benefits.

Tax Regime

Total tax on above (including cess), 3,06, This is how income tax has been calculated for Neha under the new tax regime. Up to Rs 3,00,, Exempt from tax. If you are an NRI and have any income generated in India, you are liable to pay taxes. Know the different tax regimes you can opt for and the applicable tax. The income tax slabs under the new tax regime are as follows: Rs 0 – Rs 3,00, – 0%, Rs 3,00, and Rs 7,00, – 5%, Rs 7,00, and Rs 10,00,%, Rs Tax regime is the set of rules, regulations, and policies established by a government to govern the collection, assessment, and administration of taxes. The income tax slabs under the new tax regime are as follows: Rs 0 – Rs 3,00, – 0%, Rs 3,00, and Rs 7,00, – 5%, Rs 7,00, and Rs 10,00,%, Rs PwC World Wide Tax Summaries, WWTS helps external client users to get up-to-date summary of basic information about corporate tax and individual taxes in. Ans: The tax slabs and rates are different in old and new tax regimes. Various deductions and exemptions are allowed in Old tax regime. The new regime offers. Tax incentives for individuals. There is a very favourable system of partial income tax exemption for impatriate employees. > The impatriates regime. In. The new tax regime is now the default system for calculating an individual's tax liability. This means taxes are computed based on the new regime unless the. Total tax on above (including cess), 3,06, This is how income tax has been calculated for Neha under the new tax regime. Up to Rs 3,00,, Exempt from tax. If you are an NRI and have any income generated in India, you are liable to pay taxes. Know the different tax regimes you can opt for and the applicable tax. The income tax slabs under the new tax regime are as follows: Rs 0 – Rs 3,00, – 0%, Rs 3,00, and Rs 7,00, – 5%, Rs 7,00, and Rs 10,00,%, Rs Tax regime is the set of rules, regulations, and policies established by a government to govern the collection, assessment, and administration of taxes. The income tax slabs under the new tax regime are as follows: Rs 0 – Rs 3,00, – 0%, Rs 3,00, and Rs 7,00, – 5%, Rs 7,00, and Rs 10,00,%, Rs PwC World Wide Tax Summaries, WWTS helps external client users to get up-to-date summary of basic information about corporate tax and individual taxes in. Ans: The tax slabs and rates are different in old and new tax regimes. Various deductions and exemptions are allowed in Old tax regime. The new regime offers. Tax incentives for individuals. There is a very favourable system of partial income tax exemption for impatriate employees. > The impatriates regime. In. The new tax regime is now the default system for calculating an individual's tax liability. This means taxes are computed based on the new regime unless the.

Income Tax Slabs - Know the Comparison of Tax Rates under New Tax Regime for FY & Also, Check the updated Tax Slabs for Individuals. Tax incentives for individuals. There is a very favourable system of partial income tax exemption for impatriate employees. > The impatriates regime. In. Headline rates for WWTS territories ; India (Last reviewed 15 May ), New personal tax regime: (i.e. 30% + 25% surcharge + 4% health and education cess);. Tax Slabs for AY The Finance Act has amended the provisions of Section BAC w.e.f AY to make new tax regime the default tax regime for. The New Tax Regime is a scheme of Income tax in India first proposed in Union Budget – Subsequent Budget of FY did not see any major. The old tax regime refers to the system of income tax calculation and slabs that existed before the introduction of the new tax regime. In the old tax regime. CONCLUSION. If you opt for a tax on the IS, all your distributed profits will be taxed a second time in the hands of the associates, as he will have to pay his. tax regime defines the tax slabs and rates. In the government introduced a new tax regime with higher tax rates but more options for tax savings. Tax Regimes for Holders of Federal Government Securities. 1. Tax Regimes for N/A: Not applicable. /1: Taxation in accordance with the Income Tax Law. Disclaimer-This Withholding Tar Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime The. Abstract. This chapter describes and evaluates the current regime for taxing the profit of companies in an international setting. The tax regime for new residents is dedicated to individuals transferring their residence to Italy and envisages a substitute tax on their foreign income. This. Set tax-level controls to enable the options that you want to make available to the taxes in this tax regime. If necessary, you can disable the options that you. Specifically, the individual who will transfer their tax residency to Greece and qualify for the special taxation regime will be eligible to income tax on 50%. tax return (a disregarded entity). A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files. A regime is the way that something such as an institution, company, or economy is run, especially when it involves tough or severe action. Income Tax Slabs - Know the Comparison of Tax Rates under New Tax Regime for FY & Also, Check the updated Tax Slabs for Individuals. The law was voted in parliament on 23 December and the new Belgian expatriate tax regime entered into force on 1 January With the publication of the. regimes that emphasized the state's role in resource allocation. Such Of all the forms of tax incentives, tax holidays (exemptions from paying tax. The Italian tax system provides for numerous tax regimes dedicated to people who decide to move to Italy to work or live. For example, if professors and.